French payroll tax calculator

Just enter the wages tax withholdings and other information required. Free Unbiased Reviews Top Picks.

Payroll Taxes France My Payroll Pro France

Proceed below and fill in the required fields to see your estimated tax burden.

. Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Supplementary pension contributions are 1002 401 employee 601 employer on T1 and for T2 2429 972 employee 1457 employer. The URSSAF network is the driving force behind Frances social benefits system.

The apprenticeship tax is 068 and the. Thus a couple with net taxable income of 85000 being two household parts. For example if an employee earns 1500 per week the individuals annual.

N Number of parts in the household. Free Unbiased Reviews Top Picks. The simulation can be refined by answering different questions.

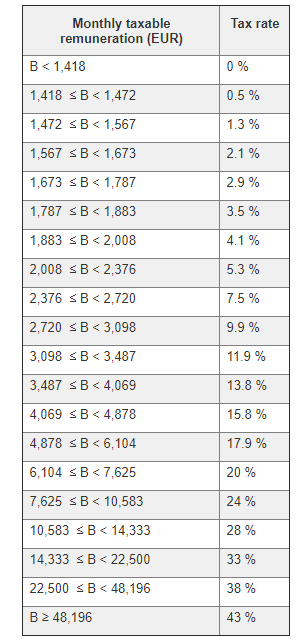

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. 3333 of the gross monthly salary times years of seniority for employees with 11. Below you will find the personal income brackets in France and the relevant taxable amount and how much of this.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. 25 of the gross monthly salary times years of seniority for employees with up to 10 years of seniority.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Ad Compare This Years Top 5 Free Payroll Software. These changing rates do not include the social cost tax of 122.

Youll then get a breakdown of your total tax liability and take. Important Note on Calculator. Rates also change on a yearly basis ranging from 03 to 60 in 2022.

Simply enter the advertised salary in the gross salary box. You can use our simulator to convert the gross salary into net salary. Interest paid to a nonresident lender by a.

The total income is divided by 2 so 850002 42500 and therefore. For 2022 the wage base is 62500. Ad Compare This Years Top 5 Free Payroll Software.

Calculate an employees net gross or total salary using the simulator provided by URSSAF. There is a 30 withholding tax on dividends that are paid to a nonresident shareholder by a French corporation unless some treaty rules apply.

Payroll Software Solution Company In India Payroll Software Payroll Solutions

Pin On Taxes

Payroll Tax Wikiwand

Payroll Character Vector Salary Wage Bank Note Png And Vector With Transparent Background For Free Download Cartoon Template Free Vector Graphics Poster Design

Sjcomeup Com Salary Calculator For France

Solved Employer Payroll Tax Expense Account

Salary Calculator With Taxes Best Sale 55 Off Www Wtashows Com

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Salary Tax Calculator Best Sale 58 Off Www Wtashows Com

Tax Calculator For Salary Deals 57 Off Www Wtashows Com

![]()

France Salary Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Time Sheet Template With Breaks Timesheet Template Templates Excel Templates

Tax Calculator For Salary Deals 57 Off Www Wtashows Com

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Tax Calculator For Salary Deals 57 Off Www Wtashows Com

France Salary Calculator 2022 23